How expensive is it to live in Germany? An overview of (almost) every cost

From rent and food to transportation and leisure, many of us might not know exactly how much we spend each month. Here’s a simple breakdown of everything that goes into the cost of living in Germany.

13 min read

How much does it cost to live? That’s a good question—especially if you’re moving into your own apartment for the first time or if you’re new to Germany. You might be experiencing other changes that will impact your monthly budget, too, like buying a car, having a child, changing jobs, or moving to a more rural area.

As always, we’ve got the answers for you! We’ve looked into the cost of living in Germany on your behalf. In this article, you’ll find out what “cost of living” means, how high it is in Germany on average, and what counts towards the cost of living—from rent and food all the way to your phone plan. Plus, we’ll give you handy savings tips and update this article regularly to reflect economic changes, like the current inflation rate. This version is based on data from September 12, 2022.

What is the cost of living?

The term “cost of living” comes from economics and describes what private households spend on day-to-day life. In simple terms, the cost of living is all your expenses for the things you need to live. So, what counts towards the cost of living? To name a few things: your home, food, toiletries, and internet plan, not to mention leisure activities and sport. Insurance policies and deductions for social security, like your pension or personal liability insurance, aren’t part of the cost of living, strictly speaking—but it’s helpful to take these expenses into account when calculating your household budget.

Here’s a table with the most important things that count towards the cost of living in Germany:

Housing | Rent or mortgage payments, energy costs, ancillary costs, household appliances, etc | Monthly average: €923 |

Food & Drink | Food, alcohol/tobacco, drinks, pet food, etc. | €378 |

Clothing | Clothing for work or leisure | €93 |

Health and toiletries | Toiletries and services, e.g. cosmetics, hairdresser, etc. | €107 |

Transportation | Public transport, shared mobility, your own car, bike, etc. | €266 |

Leisure & Culture | Cinema, theater, books, gym, sports clubs, travel, courses, etc. | €239 |

Communication | License fee, cellphone plan, internet, etc. | €67 |

It goes without saying that people have different needs and different consumer behavior. If you only buy your groceries from an organic supermarket, you’ll spend more on your food. Similarly, if you use public transport or a bike to get around, you’ll spend less than people who drive. And if you’ve got a family, you’ll have to cover the costs of having a child, like clothes, toys, and maybe even kindergarten fees.

As a result, statistics always use representative goods and price indices to calculate the cost of living. This means that the average cost of living in Germany is just a guide—it can be different for everyone.

The bank account that gives you more control

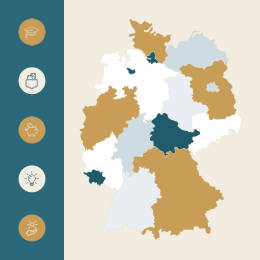

Comparing the cost of living across Germany

Whether you live in a city or in a rural area has a huge impact on your cost of living.

Rent is a lot higher in big cities like Berlin, Frankfurt am Main, and Munich than in Chemnitz, Gelsenkirchen, or Zwickau. In metropolitan areas, rent, energy, and ancillary costs often make up more than half of your expenses. In rural areas, rents are cheaper—and that’s not all. More people there own their own homes and don’t need to pay rent (but they do need to pay ancillary costs and for renovation work).

For some people, living outside of the city is worth it: People in Berlin have €250 to spare at the end of the month, whereas people in the countryside have €610, after deducting all their expenses. However, living rurally incurs other costs—like for your own car—that city-dwellers avoid. Basically, there’s no way to say for certain whether city or rural living is cheaper.

Along with the size of your home, the region where you live also impacts how much money you need each month. According to Statista, the highest average cost of living in

Germany is in the old federal states of North Rhine-Westphalia, Bavaria, and Baden, where the economy is stronger, and in the capital, Berlin. Costs in federal states in the eastern part of Germany and in the Saarland region are below average.

Germany’s most expensive cities by cost of living

So, you’re one of those people moving to the city? Here are Germany’s top ten most expensive cities, based on apartment rents in 2022, according to Statista:

1. Munich: €19.64 per m2

2. Frankfurt am Main: €16.49 per m2

3. Berlin: €15.69 per m2

4. Stuttgart: €15.31 per m2

5. Freiburg: €14.88 per m2

6. Dusseldorf: €14.20 per m2

7. Mainz: €14.17 per m2

8. Heidelberg: €14.14 per m2

9. Hamburg: €14.04 per m2

10. Darmstadt: €13.84 per m2

In contrast, the cost per square meter is €6.42 in Wilhelmshaven and just €4.95 in Plauen.

Moving to Germany?

The cost of living: average values for Germany in 2022

All told, how high is the cost of living in Germany? According to Destatis, it adds up to €2,507 a month, with 37% of this going towards housing and energy costs and 15% on food, alcohol, and tobacco (as of September 2022). If you calculate this on an annual basis, the average cost of living in Germany is €30,084. A good chunk of change, right? But bear in mind that these average figures are for private households—not just for individuals, but also couples and families.

Nevertheless, the cost of living in Germany has been going up steadily. Electricity has increased around 63% since 2007, gasoline by 30% since 2010, and food and drink cost 23% more than they did in 2017. Wages and salaries, though, haven’t kept pace with these increases—which is why more and more people have to live frugally in their old age. So, in the rest of this article, we won’t just look at the general cost of living in more detail—we’ll also point you towards some handy savings tips!

1. Housing

You know this already: Housing costs make up the biggest proportion of the cost of

living. According to data from Statista, the average housing expenses in Germany are around €923 per month, representing an average of 36.8% of all consumer spending.

The cost of rent

Want to rent an apartment and save money? In a city like Frankfurt or Munich, you’ll probably have to move into a shared apartment or follow our other savings tips when renting an apartment. As seen in the list above, you’ll pay a monthly rent of almost €20 per square meter in these cities (as of September 2022). For a 50 m2 apartment, this rent would be €1,000, compared to €250 in Plauen. Along with rent, there are other factors to consider, especially energy and other housing costs.

Water, electricity and gas expenses

The fact that water itself isn’t free becomes clear when you receive your bill for ancillary costs. Drinking water is an operating cost, just like the cleaning of shared spaces and waste disposal. A cubic meter of water costs around €2. And what does 1,000 liters of water cost? Trick question! That’s €2, as well—a cubic meter of water is 1,000 liters. Either way, tenants have little impact on their water costs. They’re already included in your rent and split among everyone living at your address. If you want to buy or build a house, though, you need to keep a closer eye on these ancillary costs.

Energy prices make up a heftier chunk of housing costs. For new customers, gas currently costs 39.5 cents per kilowatt hour (kWh, as of September 2022). In comparison, a year ago, in September 2021, it was 5.8 cents per kWh. That’s because gas prices have skyrocketed in recent months due to geopolitical tensions. Alongside paying for your own gas usage, you’ll also pay a flat-rate standing charge. Even though it’s not easy, here are a couple of ideas to reduce your gas bill.

The cost of 1 kWh of electricity is around 42 cents (as of September 2022). A one-person household uses 1,300 kWh per month, on average, so your electricity will cost around €55 a month. In this article, you’ll find out how to cut your electricity bill and get some money back.

Send money abroad

Household contents insurance

Officially, insurance doesn’t count towards the cost of living in Germany. But household contents insurance is absolutely crucial to protect you against theft, storms and break-ins. Your household contents insurance will likely cost at least €10 a month. Often, the cost of household contents insurance is calculated by square meter. In other words, it’s affected by how big your home is.

2. Food and drink

Expenses for food, drinks, alcohol, and tobacco take second place on the list of monthly expenses within the cost of living, after rent. They have seen a steady increase in recent years, as a survey by Statista showed.

Average spending on food and drink

On average, monthly food costs come to €387 per household, including drinks and tobacco. Of course, it also matters whether you do your shopping in discount stores or organic shops, whether you regularly get drinks delivered, or whether you smoke. However, food prices are currently going up due to inflation and other factors, which impacts every single consumer. The price of butter has almost doubled, going up by 47.9%, within a year, while bread and cereals are an average of 15% more expensive (as of July 2022). There’s not much you can do about these price increases, but there are tips for saving money when buying groceries.

Pet costs

Whether you’ve got a dog or a cat, pets also incur regular costs. These costs are mostly for pet food, which is why these expenses fall under the food and drink category. Cat food costs around €25 a month. Dog food costs around €10 to €300 a month, depending on the dog’s size and the quality of the food you buy.

3. Clothing

Whether for work or leisure, it’s said that clothes make the (wo)man. On average, this aspect of the cost of living in Germany adds up to €93 a month. Incidentally, you can also offset your work clothing from your tax—and get back some of the income tax you’ve paid!

4. Health and toiletries

Prevention is the best cure when it comes to health. If you like to exercise, the expenses for this also come under your cost of living, like sports courses, club and gym memberships, or the cost of a personal trainer. Of course, there are also ways to exercise for free. Toiletries and personal care products like toothpaste, shower gel, and toilet paper are also part of your monthly cost of living. On average, health-related expenses come to €107 per household.

If we go by the book, health insurance costs are not part of the cost of living in Germany because employees have them deducted from their gross salary. This also goes for private health insurance costs. If you’re self-employed and pay social security yourself, though, you should take these costs into account in your budget.

5. Transportation

No matter how nice it is within your own four walls, we sometimes have to (or want to) go to work, see family and friends, and engage in leisure activities. How much this costs depends on how you like to get around. On average, transportation in Germany comes to €266 a month, with €233 down to your car and €33 down to public transport.

Buying a car

Wondering how much a car costs? Alongside the actual cost of your new or used car, you need to register the car, at a one-off cost of around €30. If you want to re-register your car after moving house, this costs around €50. Then you’ve got the recurring costs of insurance, fuel, and maintenance.

Car insurance costs

The cost of car insurance in Germany depends on various factors. New drivers tend to pay more because they pose a greater risk, in insurers’ eyes. The terms of the insurance policy play a role, too. The annual cost of car insurance is around €250. The price can go up to either €340 or €565 a year, depending on whether you opt for fully or partially comprehensive coverage.

Save AND shop

Car repair costs and maintenance

If your headlamps aren’t working or your car’s got an ugly dent, sometimes your car needs repairs. On average, this amounts to €55 a month. Then there are the TÜV costs of a vehicle inspection, which were around €120 in 2022. Bear in mind that this car inspection costs different amounts depending on your region and the company carrying out the inspection.

Filling up

Whether you’ve got an electric car or a vehicle with a traditional combustion engine, you need to refuel it—either with gasoline or electricity. A household spends between €72 and €106 on fuel each month, with this figure often impacted by external factors such as economic or other crises. According to Statista, gasoline prices, for instance, have increased substantially in 2022. Gasoline prices in Germany are around €2 a liter right now, with diesel around €2.16 and Super E10 at €1.99 (as at September 2022).

If you want to charge your electric car, this’ll cost up to 79 cents per kWh. Prices are based on current electricity prices and vary hugely depending on the provider of the charging point.

Public transport

Prefer to travel by bus or train? Costs differ depending on your region. On average, the price of a monthly bus or train ticket is €80—but it’s €57 in Munich and €112.80 in Hamburg. The cost of a single ticket for buses can vary just as much. Interestingly, Munich tops the list this time at €3.40, while Hamburg is the cheapest, with a single ticket costing €2.40. Looking at Germany as a whole, the average monthly spending on public transport is €33. In cities, monthly expenses for this are generally higher than in the countryside, where more people drive.

6. Leisure and culture

From the cost of Netflix to museum tickets to vacations: German households spend an average of €239 a month on cultural and leisure activities. This was the finding of a survey by Statista. It might sound like a lot at first glance, but just one holiday can push up the average figure a great deal. Of course, there are lots of ways to cut costs here. For example, you could share your Netflix account with others, go to museums at specific times when admission is cheaper, or attend free concerts. You can also check out our tips for budget-friendly travel.

Educational expenses are part of the cost of living, but the definition says this actually relates to further training and professional development. An analysis performed by Destatis revealed that people spend around €16 a month on education. That’s around 0.6% of the cost of living in Germany. If you’re still at university, you can take expenses relating to your studies, like learning material or semester fees, into account in your personal budget. Check out our blog for students for practical tips.

7. Communication

The general cost of communication has increased slightly in recent years and is now at €67 a month. Destatis includes TV in this figure, alongside phone and mail.

Cable TV costs

The costs of your cable connection are often included in the ancillary costs for an apartment and make up an average of €10 to €15 a month. You’ll still pay these charges even if you don’t watch TV—but only until July 2024, when this practice will be abolished.

This doesn’t include the HD TV costs charged by streaming services. Depending on the provider, you’ll pay an average of €6-10 each month for internet TV. This is the cheaper option, on average, the picture quality is better, and you can watch TV on all your devices.

Phone and internet

Phone and internet cost an average of €47.11 a month, made up of €16.28 for cellphone use and €30.83 for internet connection. Prices vary depending on the provider, amount of data, and internet speed. And by the way: if you also use your private smartphone or internet for work or if you’re self-employed, you can offset these expenses against your income taxes.

Your money with N26

All these numbers making your head spin? Luckily, we’ve got lots of handy tools that help you keep an eye on your income and expenses. With N26 Insights, all your account activities are automatically sorted by category and listed for you each month. Just create tags like #transportation or #rent for your card payments and get a precise overview of how much you’re spending month to month.

At N26, we’ve taken the red tape out of opening a bank account in Germany. Open an online account in minutes—all you’ll need is your smartphone, a valid address in Germany, and a valid photo ID. You’ll get an official German IBAN, so you can pay and be paid like a local. Plus, there are no hidden fees and you’ll always have access to English-speaking customer service, so you can focus on settling in to your new home.

Find similar stories

By N26

Love your bank

Related posts

These might also interest youHow to open a bank account in Austria the easy way

Thinking about moving to Austria? You’re going to need a bank account. Here’s how you can get one.

How to open a bank account in Slovenia

Find out everything you need to know about opening a bank account in your new home.

How to open a bank account in Sweden

Opening a local bank account will make your transition that much smoother.